EMI Calculator

With optional savings features

Loan Summary

Monthly EMI: ₹

Total Payment: ₹

Total Interest: ₹

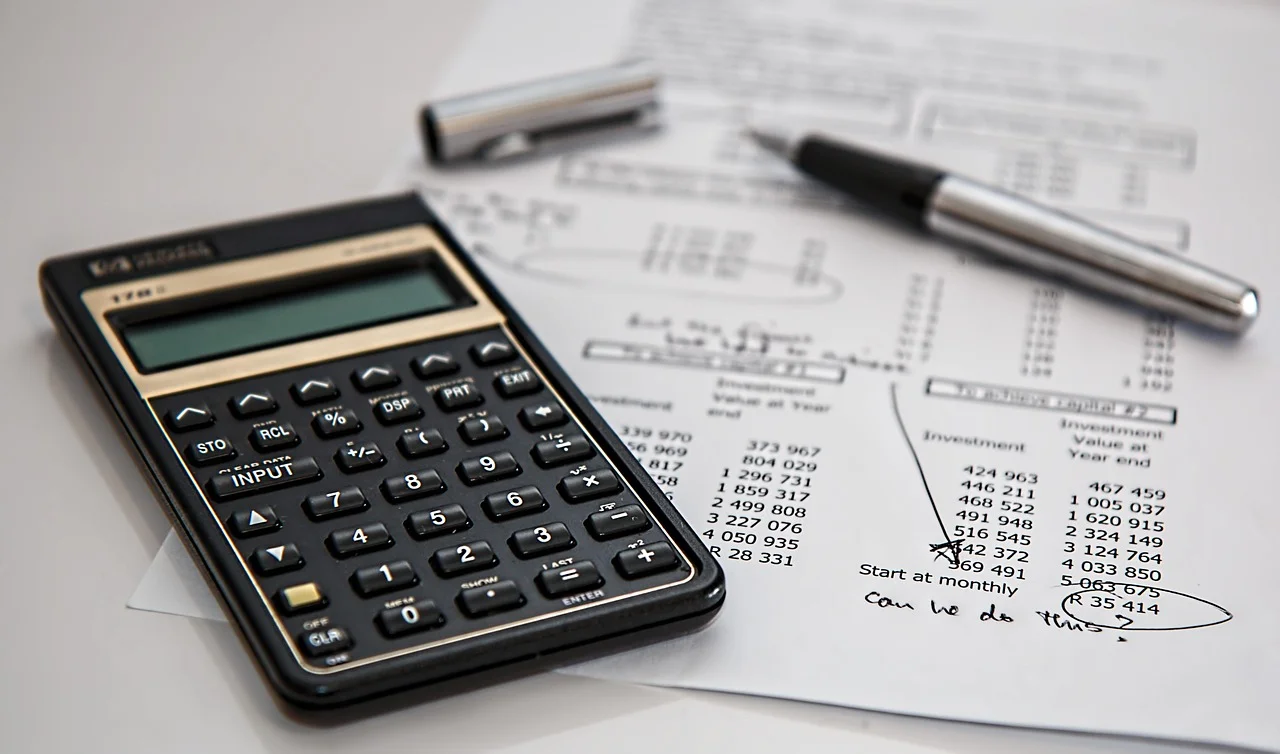

The EMI calculator has sub-segments like home loan EMI calculator, car loan EMI calculator, personal loan EMI calculator, loan against property EMI calculator, etc. The concept of EMI is the same; just the tenure and interest rates differ.

Buying a new car feels exciting, but money worries can quietly steal that joy. You want comfort for your family, not stress at the end of every month. That is where an EMI calculator brings peace of mind. It helps you see the full picture before you sign any papers. When you know your monthly payment in advance, you feel confident, calm, and in control. No surprises later, no sleepless nights. Just clear planning and a happy drive ahead.

Why Bother with an EMI Calculator?

An EMI calculator saves you from guesswork. Instead of rough estimates, you get exact numbers based on your loan details. This helps you choose a car that truly fits your budget, not just your wish list. It also protects you from over-borrowing, which can strain family finances. With one quick calculation, you can compare loan options and decide what feels comfortable each month.

Today’s Loan EMI Calculator Interest Rate 2026

The current loan interest rates significantly impact your monthly EMI calculation. As of 2026, leading lenders in India offer the following rate ranges:

| Lender | Interest Rate (p.a.) |

|---|---|

| State Bank of India | 7.50% – 8.95% |

| HDFC Bank | 7.90% onwards |

| Bajaj Housing Finance | 7.35% onwards |

| ICICI Bank | 7.70% onwards |

| Axis Bank | 8.35% – 11.90% |

| Punjab National Bank | 7.45% – 9.35% |

| Kotak Mahindra Bank | 7.99% onwards |

| Canara Bank | 7.40% – 10.25% |

| IDFC FIRST Bank | 8.85% onwards |

| Bajaj Finserv | 7.45% – 10.35%* |

The Basics: Factors Affecting Your EMI

Your EMI depends on a few simple things. First is the loan amount, which is the money you borrow. Second is the interest rate charged by the lender. Third is the loan time, usually counted in months. A higher loan or interest rate increases your EMI. A longer loan time lowers monthly payments but raises total interest paid.

Step-by-Step Guide: How to Use the Calculator

Using an EMI calculator is easy, even if numbers scare you. Enter the loan amount first. Next, add the interest rate offered by the bank. Then choose the loan duration. Hit calculate. That is it. Within seconds, you see your monthly EMI. You can change values to find a balance that feels right for your household budget.

The EMI Formula Explained Simply

Behind every calculator is a fixed formula. You do not need to remember it, but knowing it builds trust.

EMI Formula:

EMI = [P × R × (1 + R)^N] ÷ [(1 + R)^N − 1]

Where:

- P is the loan amount

- R is monthly interest rate

- N is number of months

The calculator handles this math for you, so there is no confusion.

Top Benefits of Using an EMI Calculator

An EMI calculator offers real value beyond simple math.

- Helps you plan monthly expenses better

- Shows if a car loan fits your income

- Makes loan comparison fast and easy

- Avoids future money stress

- Builds confidence before loan approval

These small advantages add up to smarter decisions.

| Loan Amount | Interest Rate | Tenure | Monthly EMI |

|---|---|---|---|

| ₹6,00,000 | 9% | 5 Years | ₹12,460 |

| ₹6,00,000 | 10% | 5 Years | ₹12,748 |

| ₹6,00,000 | 9% | 7 Years | ₹9,700 |

This table shows how small changes affect your EMI.

Pro Tips for Smart Borrowing

Always keep your EMI below a safe part of your monthly income. A good rule is under 30 percent. Try to pay a higher down payment to reduce the interest burden. Compare banks before choosing. Shorter loan periods save money long term, even if EMI feels slightly higher.

Final Verdict: EMI Calculator

An EMI calculator is not just a tool. It is a financial safety net. It helps families buy cars with clarity and confidence. When you plan before you borrow, you enjoy your car more and worry less. For anyone thinking about a new car loan, this calculator is the first step toward stress-free ownership.

FAQs About EMI Calculator

What does an EMI calculator do?

An EMI calculator shows how much you need to pay every month for your car loan. It uses your loan amount, interest rate, and loan time to give quick results.

How to prepare an EMI schedule?

Enter loan details into an EMI calculator. It creates a full payment plan showing monthly EMI, interest, and remaining balance over time.

How do you calculate EMI?

EMI is calculated using a fixed formula that includes the loan amount, the monthly interest rate, and the number of months. Online calculators do this instantly.

How to calculate the monthly EMI payment?

Just add the loan amount, interest rate, and tenure into an EMI calculator. The monthly EMI appears in seconds.

Which formula is used for EMI?

The EMI formula is based on compound interest and fixed monthly payments. Most banks follow the same standard formula.

How to create an EMI calculator?

You can build one using the EMI formula in Excel or a simple coding tool. Many websites already offer free versions.